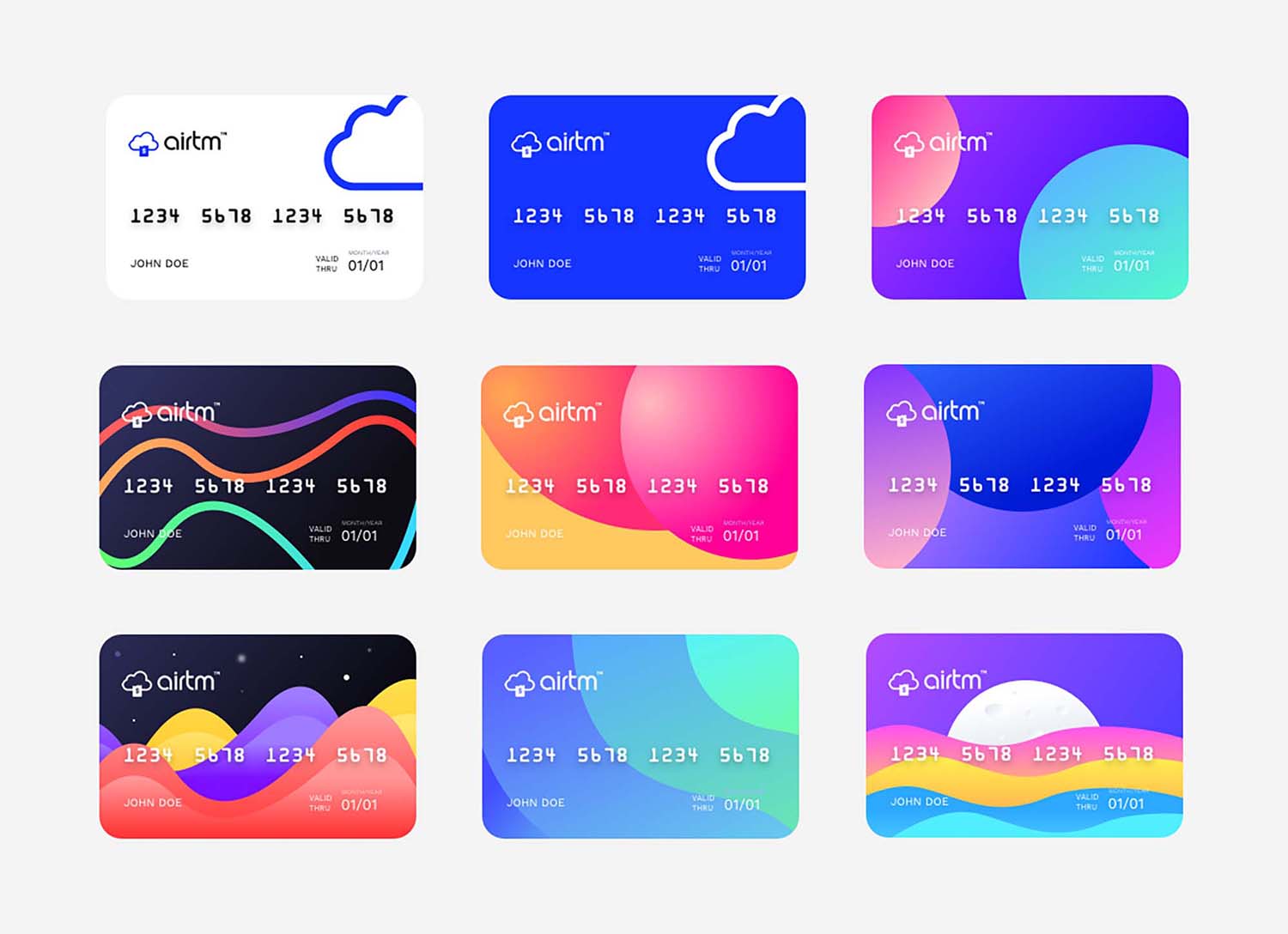

VIRTUAL CARD FULL

Here, we’ve outlined the top three ways businesses can benefit from virtual credit cards and make remote payments transparent and accessible. Despite remote work, paper invoices and checks continue to run through mail boxes except now you have to make the trip to the office to collect them. The pandemic has challenged the popular belief that payment processes only need to be completed from an office building. What are the benefits of a Virtual Credit Card? In 2018, VCC initiated purchases accounted for 169 billion this number is projected to reach $355 billion by 2022, according to Accenture. Research indicates a strong spike in businesses using virtual credit cards. Vendors will process a virtual card the same way they would process a regular credit card, but without seeing the physical card number.

A virtual credit card (VCC) is a unique number generated automatically during a transaction.

0 kommentar(er)

0 kommentar(er)